It might take a lot of time and be complex to get life insurance. There isn’t much assurance that you’ll receive a decent bargain when comparing plans, speaking with insurance salespeople, and learning on the job.

So many companies switched the majority of their activities online in 2020. Customers were accustomed to using their web browsers to do tasks quickly. Another excellent online choice for life insurance is Everyday Life Insurance.

It enables online life insurance applications and price requests. A life insurance policy you buy from Everyday Life will automatically modify after you have it so that you are only ever paying for what you actually need. If this appeals to you, continue reading as we discuss Everyday Life Insurance.

What Is Everyday Life Insurance?

An insurtech firm called Everyday Life Insurance (Everyday Life, Inc.) offers technology-driven life insurance policies. Jake Tamarkin is the company’s co-founder and CEO. Located in Boston, Massachusetts, it was established in June 2018. The business has received startup capital of $785,000.

Everyday Life Insurance employs technology to crunch the statistics of comparable profiles rather than giving a static estimate based on a potential customer’s comments. Everyday gains some level of assurance in the precision of its consumer offers because of the inclusion of such data.

Furthermore, Everyday has the flexibility to modify its rules as circumstances change. This is referred to as Predictive Protection. Predictive Protection is designed to offer the appropriate level of insurance so that consumers don’t spend too much for coverage they don’t require.

Everyday Life Plans

Plans for regular insurance are tailored to your needs. By doing this, it is possible to save money on unnecessary insurance. For instance, even though you may only need a 20-year plan, you may get a 30-year term life insurance policy from a standard insurance provider. You shouldn’t anticipate receiving a call from a typical insurance provider informing you that you have too much coverage.

Five years after purchasing the same 30-year plan, you can realize that you only require a 20-year one. Everyday may automatically change your policy to a shorter term to minimize your monthly premium by using policy stacking. Everyday claims that as compared to flat coverage choices, the typical consumer saves 50% over the course of the insurance.

Although there is a huge chance for long-term savings, you still want your first rates to be affordable. For a 30-year-old man in good health who wants $500,000 in coverage for 20 years, we ran a sample estimate with Everyday and other life insurers. Everyday Life Insurance produced a pricing quotation of $35.24 per month for these specifications.

How Do I Apply For A Policy?

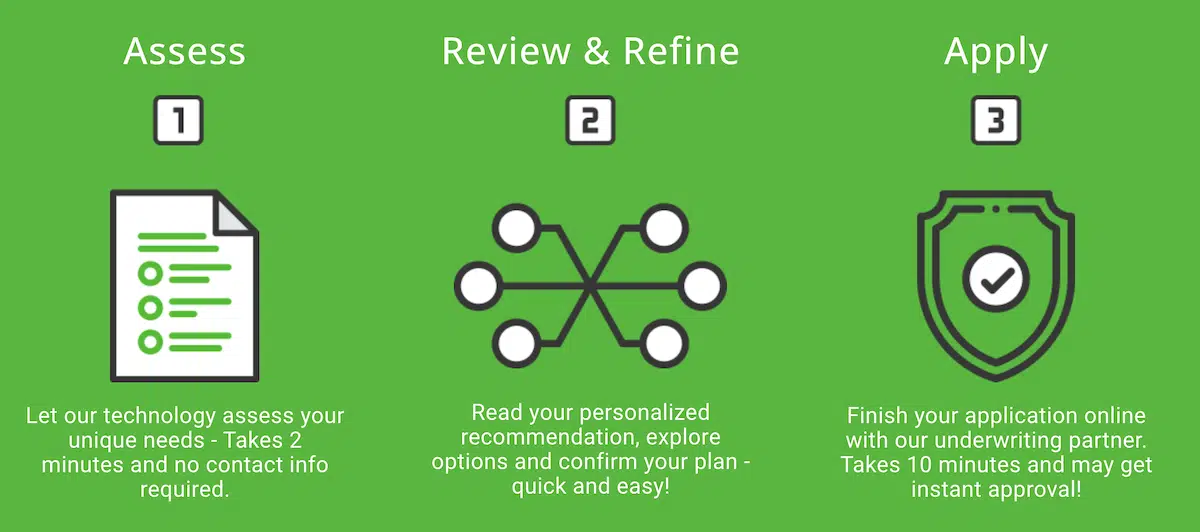

The Everyday Life application process consists of three steps, each of which can be finished online. Compared to a regular insurance provider, there is less paperwork, and a medical visit is not necessary. In fact, you could hear back with approval in less time than 15 minutes.

- Fill Out A Questionnaire :Your personal information is not required for the daily questionnaire. However, it will inquire about your family, dependents, salary, place of residence, birth date, and other fundamental details. In less than two minutes, you should be able to complete all the necessary fields and begin comparing different insurance plans.

- Review Suggested Plans :Depending on any modifications, other strategies can be recommended. All plans will be made specifically for you based on your profile (which you may always alter). The monthly rates and amounts dependents receive will also be shown.

- Choose And Adjust Your Plan :Depending on your changes, you’ll see the monthly rate alter in real time. You will finish the application with one of Everyday’s underwriting partners (Legal & General and Fidelity Life) after you are happy with the changes.

You are free to ask the underwriter any questions at this time. Rarely, a medical examination could be necessary. This last action should just take a few minutes.

Yes, Everyday Life Insurance is worth looking into if you want to conduct business online. Others, though, might be wary given that Everyday has only been operational since 2018.

Financial stability shouldn’t be a huge problem for Everyday as it is backed by Legal & General, an 184-year-old corporation with an A+ A.M. Best rating, and Fidelity Life, a 125-year-old insurer with an A- A.M Best rating.

However, Everyday is the one you’ll experience if there are any problems. Furthermore, it’s unknown how effectively its “Predictive Protection” will function over time.

Everyday Life Insurance Features

|

Term Lengths |

10, 15, 20, and 30 years |

|

Coverage Limits |

$100,000 to $5 million |

|

Age Limits |

18 to 70 |

|

Medical Exam Required |

No, but it may be requested under certain circumstances |

|

Same-Day Approvals |

Yes, if no additional information is requested by the underwriter |

|

Renewable Plans |

Yes |

|

Early Access to Benefits |

Yes |

|

Anonymous Quotes |

Yes |

|

Convertible to Permanent Insurance |

Yes |

|

Available Riders |

None publicly listed |

|

Coverage Partners |

|

|

Customer Service Number |

1-888-681-3811 |

|

Customer Service Email |

|

|

Mobile App Availability |

None |

|

Promotions |

Get a $25 Amazon gift card for referring a friend |

PROS

- The whole application procedure is conducted online

- Insurance automatically modifies to reflect life changes

- Unusual need for medical examinations

CONS

- New business with a little history

- There are few online consumer testimonials.

Summary

Everyday Life Insurance’s technology leverages your life milestones to automatically modify your coverage.