Ethos Life offers a great digital platform to quickly and conveniently compare life insurance rates online. It’s simple and affordable, especially if you are young and healthy.

In this Ethos Life review, we will explain the pros and cons of working with Ethos, their product offerings, and show sample pricing. We’ll also compare them to other companies.

Founded in 2017, Ethos has developed an online platform that allows you to apply for life insurance and possibly get instant approval. They have teamed up with Banner Life – Legal & General America, Ameritas Life Insurance Corp., TruStage for term life insurance, AAA Life for guaranteed issue whole life, & Munich Reinsurance to reinsure the larger cases. These are the companies that you are actually providing the life insurance you are buying, not Ethos. People between the ages of 20 and 65 can choose from 10-, 15-, 20-, and 30-year term policies with up to $1.5 million in coverage. Those aged 65 to 85 can choose up to $25,000 in coverage for guaranteed issue whole life insurance.

PROS & CONS OF ETHOS LIFE

Pros

Cons

With Ethos life, you can get quotes from several different carriers at the same time. This saves time and makes it easier to compare different life insurance companies so you can take the time to find the one that’s the best fit for your life insurance needs. You can get a quote and complete the application online, which takes just a few minutes, depending on your medical history.

Life Insurance Coverage Options

To begin our Ethos life review let’s examine the whole vs term life insurance.

- Ethos term life offers people the option to choose from a 10-year, 15-year, 20-year, or 30-year term option. It expires after a certain term, and you need to renew it for it to continue.

- Ethos whole life lasts for the entire life and guarantees a payout. You can use cash for emergencies or retirement. After your passing, your beneficiaries will receive the available amount after the deductions. They also cost five to fifteen times more than term life insurance.

The life insurance provider has also made it easy for people to obtain whole and term life insurance rates by age and other factors by providing them with the term life calculator. Their coverage calculator asks you to provide your age, gender, tobacco use, birthdate, general health valuation, lifestyle and eating habits, ZIP code, and answer a few questions.

Using your information, the calculator recommends a coverage amount for a certain term limit and an estimated premium rate each month.

Riders

Ethos life provides you with life insurance riders, which you can add to your life insurance coverage for extra protection:

- Child Rider Life Insurance – This covers children until they turn 25 years old.

- The Waiver of Premium Rider – If you become severely disabled, you can stop paying the premiums.

- Endowment Benefit Rider – The life insurance company will refund a part of the premiums you have previously paid them after a specified duration.

- Accelerated Death Benefit Rider – The rider provides you the ability to receive a portion of the payment during your lifetime in the event you become diagnosed with a critical illness such as cancer. You can use the amount towards hospital bills, for instance. If you pass away from your illness, the insurance company reduces the payment due to the critical illness coverage.

Ethos Life Pricing

The term life insurance rates start at $100,000 and go up to $1.5 million. People between the age of 20 and 65 can request term life insurance quotes. The life insurance company also provides an accelerated death benefit rider with their term life insurance at no cost.

Your beneficiaries will receive the face value of your term life insurance policy. Still, if you opted for the accelerated death benefit, they’ll subtract the money you already used during your lifetime.

The chart below is of sample quotes for 2 non-smoking men, aged 35 and 45 in good health:

| Male, aged 35 | |

| Coverage Amount | Premium |

| $365,000 | $29 |

| $685,000 | $49 |

| $1,000,000 | $69 |

| Male, aged 45 | |

| Coverage Amount | Premium |

| $278,000 | $39 |

| $447,000 | $59 |

| $827,000 | $99 |

Ethos Life Discounts

Ethos doesn’t offer customer or employee discounts. If you’re an employee, you receive several benefits such as comprehensive insurance benefits, unlimited paid leave, catered meals, parental leave, team events, and stock options.

Customer Satisfaction and Financial Strength Review

In terms of Ethos life complaints, the amount of complaints is average for the size of the company. Ethos has a good financial strength rating on the market due to its quality policies and customer service. The Ethos life AM Best rating is A- and their S&P rating is AA-. The Ethos life BBB rating is A+. Trustpilot gave the company a 4.5 rating.

Since Assurity Life Insurance Company underwrites and issues Ethos’s policies, customers can be at ease, knowing that they are getting a policy through one of the most reliable life insurance providers in the United States. Ethos also collaborates with other insurance giants to provide its services.

| Platform | Rating |

| BBB | A+ |

| ConsumerAffairs | N/A |

| S&P | AA- |

| Trustpilot | 4.5 |

Customer Support

Ethos life customer service number is (415) 322-2037. You can also text them at (415) 702-1844 or email them at [email protected]. Their working hours are Monday – Friday, from 8 a.m. to 6 p.m.

For policy activation, call (415) 855-4331 or email at [email protected]. If you’re experiencing payment issues, email them at [email protected].

Ease of Buying and Claims Handling

You can buy insurance coverage by completing an application form on the company’s website. The online application takes as little as 10 minutes. The company’s representatives will get back to you in a couple of hours or days.

The life insurance company doesn’t require you to make a doctor’s appointment to qualify for life insurance. The life insurance provider uses custom analytics to examine your application and make a decision based on your case. They will examine your finances, your life stage, and other factors to determine the life insurance policy most suitable for you.

You need to provide them with your credit card information when you apply for life insurance. After you fill out the application, you will be asked to choose a payment method. Providing them with a payment method beforehand allows the life insurance company to process your application faster because they know that you will make the payment. It increases the underwriting process from 7 days to 10 days instead of taking 10 weeks.

Ethos also gives you time to decide if you want to accept the policy. If you do, you make the first payment. They also provide additional resources to help you make the decision. You can create an Ethos life login to access your information.

All Ethos claims are made through email. Beneficiaries can send them an email at [email protected] to notify them of the policyholder’s passing. An Ethos representative will explain the claims process.

Once you have filed your claim, Assurity, the insurance company that underwrites their policies, will examine the claim and, if approved, send payment to your beneficiaries.

Ethos life

Ethos’ term and whole life insurance can be applied for and purchased completely through its online quote system. The company utilizes technology and algorithms that process your data, such as motor vehicle and prescription drug records, to see if you qualify for an Ethos policy and to set the most accurate rate possible.

Online life insurance through Ethos can be applied for and approved very quickly when compared with traditional insurers. Ethos’ application includes basic questions — like your birthday, height, and weight — as well as health and lifestyle questions that are for the purpose of evaluating your insurability. Often, with traditional insurers, the process takes weeks before your coverage begins and the life insurance policy is delivered. With Ethos, this is not the case, as the application is entirely online, and you can receive approval within minutes if a physical is not required.

Policies with a death benefit of less than $1 million will not require a medical exam but will require a small questionnaire. If you are looking for more than $1 million of coverage, you may also qualify for life insurance with no medical exam unless the algorithm detects a potentially serious medical issue. In this case, you may be required to get a medical exam or could be denied coverage entirely.

Ethos term life insurance

Ethos offers term life insurance policies available for purchase if you are between 20 and 65 years old, although the specific coverage available to you will depend on your age. Policy term lengths and restrictions include:

- Ages 20-50: Term policies available up to 30 years in length (both smoker and nonsmoker)

- Ages 51-60: Term policies available up to 20 years (both smoker and nonsmoker)

- Ages 61-64: Term policies available up to 15 years (both smoker and nonsmoker)

These lengths represent the number of years that you will pay premiums and the length of coverage you will receive. Once the policy term is over, Ethos does allow for one-year policy renewals up to the age of 95. But premiums for the renewal policy will increase annually, every time the policy is renewed.

You can purchase a term policy through Ethos with coverage ranging from $20,000 to $1.5 million. When compared to other online insurers, like Haven Life, whose policy face values range from $100,000 to $3 million, the death benefit range provided by Ethos’ term life insurance is much more restrictive at the top end.

Ethos whole life insurance

Ethos also offers guaranteed whole life insurance policies for individuals between the ages of 65 and 85. These plans are a form of permanent life insurance, meaning they will last the entirety of your life so long as you continue to pay the premiums. Policy face values are flexible, with options available such as:

- $10,000

- $15,000

- $20,000

- $25,000

Additionally, guaranteed whole life plans through Ethos come with an accidental death benefit, cash value accruals and reduced paid-up insurance options.

If you are looking for a life insurance plan, then we recommend getting a quote from Ethos, as its plans are widely available. Ethos policies can be found in 49 states and the District of Columbia (excluding New York).

Ethos policy riders

Ethos only offers one policy rider for its life insurance policies — an accelerated death benefits rider. This comes included and allows you to access a portion of the death benefit while you are still alive given you have a qualifying medical condition.

Another option that Ethos offers to some policyholders is the ability to convert your term life insurance into a whole life policy at any point during the plan’s lifetime.

Ethos life quotes

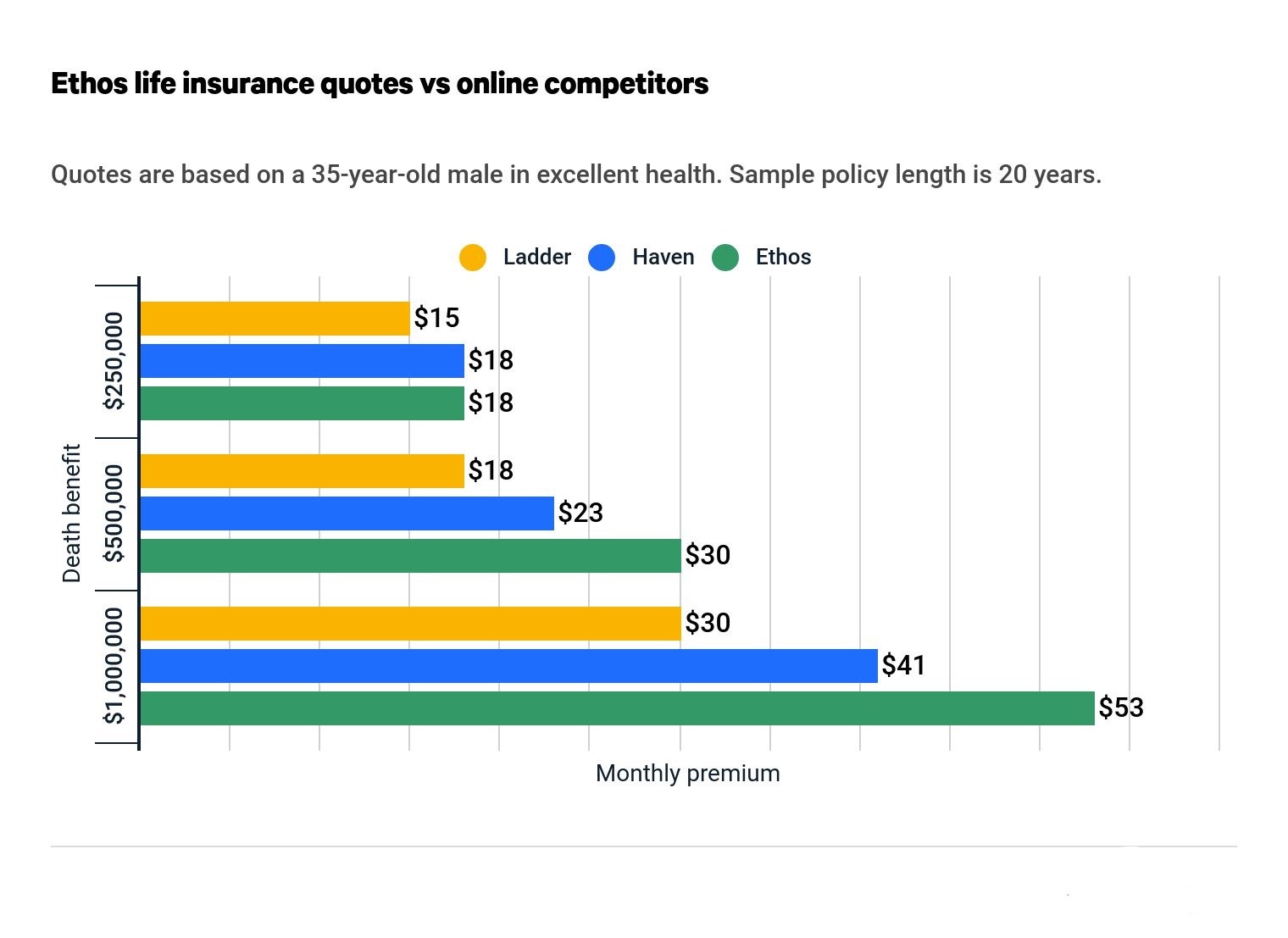

Ethos’ term life insurance rates are more expensive compared to other online insurers across most coverage levels. In general, if you are looking for the cheapest life insurance policy, there are other options available such as Ladder life insurance, which has cheaper policies at all coverage levels we analyzed.

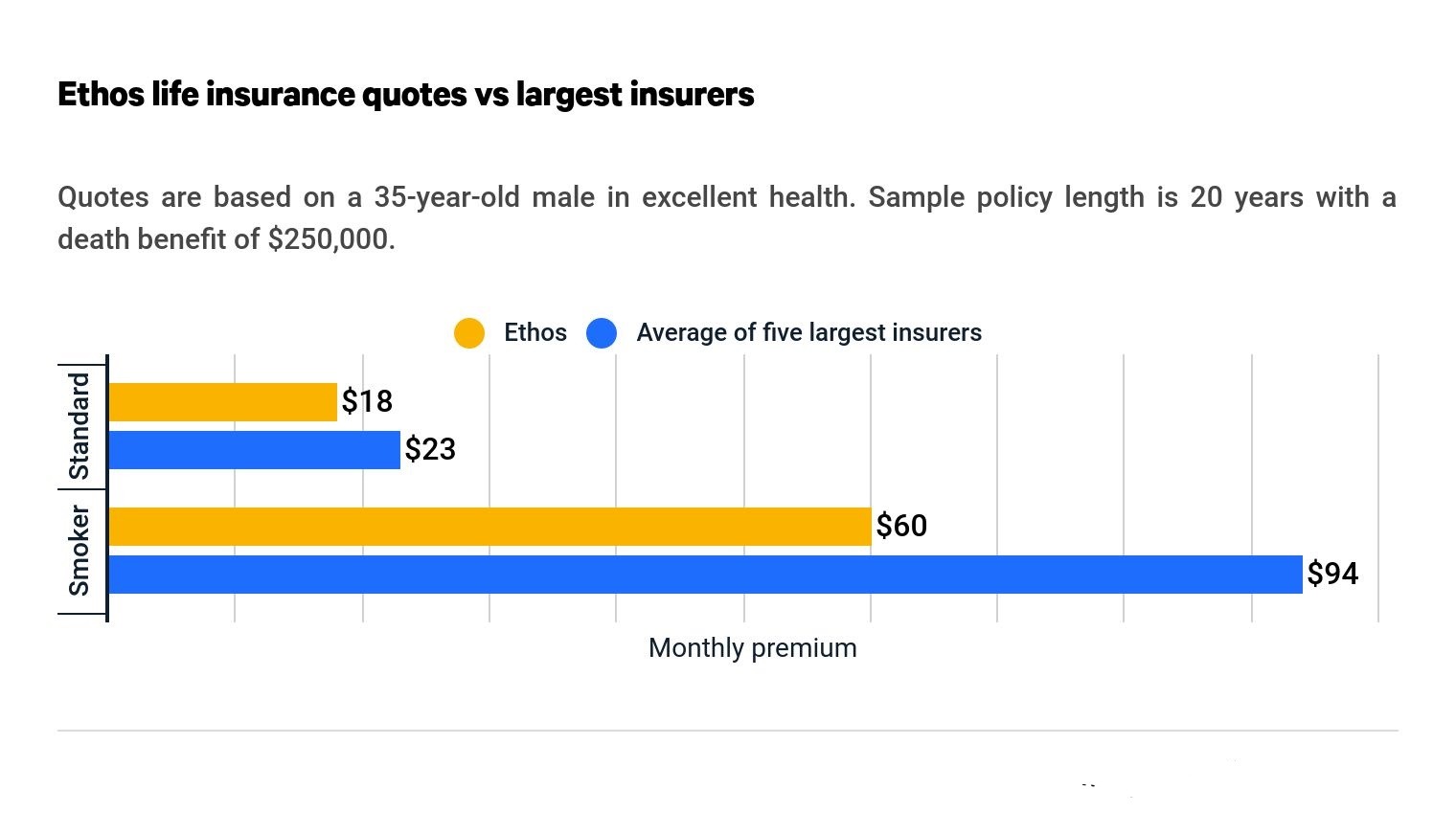

As you can see below, Ethos’ rates are cheaper compared to traditional offline insurers. This is especially the case for smokers, who have monthly rates that are $34 cheaper. When considering life insurance, you should get quotes from a variety of providers, as your individual health situation and characteristics will change the rate you receive from the insurers.

As you can see below, Ethos’ rates are cheaper compared to traditional offline insurers. This is especially the case for smokers, who have monthly rates that are $34 cheaper. When considering life insurance, you should get quotes from a variety of providers, as your individual health situation and characteristics will change the rate you receive from the insurers.

Ethos life ratings and customer reviews

Ethos life is a startup that was founded in 2016 by its current CEO Peter Colis and CTO Lingke Wang, and is headquartered in San Francisco. The company board includes many Stanford University graduates, along with many legitimate high-profile investors. Investors include Jay-Z’s company Roc Nation, Robert Downey Jr., Kevin Durant, and Will Smith. Furthermore, Ethos has additional backing from Sequoia Capital, SoftBank, and GV (formerly Google Ventures), which is a subsidiary of the parent company Alphabet Inc.

The company is very new, but customer reviews on the products are positive, with the ease of the application and speed of approval being the highest-rated aspects of Ethos. Furthermore, you can contact Ethos through email, call, and text regarding issues with your policy or claims. This means that if you have questions, then you can easily access help and be able to chat directly with a knowledgeable representative.

Policies offered through Ethos are underwritten by some of the most established insurers within the life insurance industry. They include companies such as Legal & General America, Ameritas Life Insurance Corp., AAA Life, and TruStage, which all have strong financial strength ratings.

Frequently asked questions

What is the best life insurance company?

There are many life insurance companies out there and different companies are better for different people. Look for a life insurance company with positive customer reviews and a strong financial rating from Moody’s or AM Best. Get quotes from several companies to compare rates and coverages to find the best life insurance company, or speak with a licensed insurance agent.

Who is an Ethos life policy best for?

Ethos life is best for individuals comfortable with buying a life insurance policy online. One of the biggest advantages of Ethos Insurance is its no-medical-exam policy. In most situations, there is no need for an in-person medical exam.

What’s the difference between a whole and term life insurance policy?

Both provide a death benefit. A term life policy has a set time frame of typically 10, 20, or 30 years and premiums are cheaper. A whole life insurance policy is permanent — as long as the monthly premiums are paid, the policy remains in effect. Whole life insurance is more expensive than term life because a portion of the premiums goes into a cash-value account that can be accessed before death.