Want to learn how to invest in wine?

Investing in wine has its intricacies. And you might not have a nose for good wine like well-known wine critic Robert Parker.

But you don’t need to.

Today, wine investing is no longer an elite pastime!

There are wine stock exchanges, wine-specific investment funds, professional storage solutions to store your bottles as they age, and plenty of avenues to easily buy and sell your assets.

In this article, we’ll show you everything you need to know about investing in wine, what you should expect, and three ways to invest in wines.

What Is A Wine Investment?

The quality and scarcity of fine wine appreciate over time – and so does its value. This is the underlying principle of investing in wine.

You buy bottles of wine and store them to sell them at a higher price later on.

In some cases, you may not even physically possess the bottle of wine you bought. You can have them stored professionally in specialized facilities for years, This way your valuable French wines are safe and in perfect condition until you turn a profit!

If wine collecting and storing is not for you, you could try investing in blue-chip wine stocks and funds.

But if you want a simpler solution, you could rely on a wine investment company to buy and store your wines for you, without you having to take on any of the headaches of having to build your own wine cellar.

Why Invest In Wines?

Investing in wine is a profitable alternative investment option for investors and wine drinkers to diversify their portfolios.

Additionally, fine wine has a low correlation with the sluggish global stock market.

Here’s how:

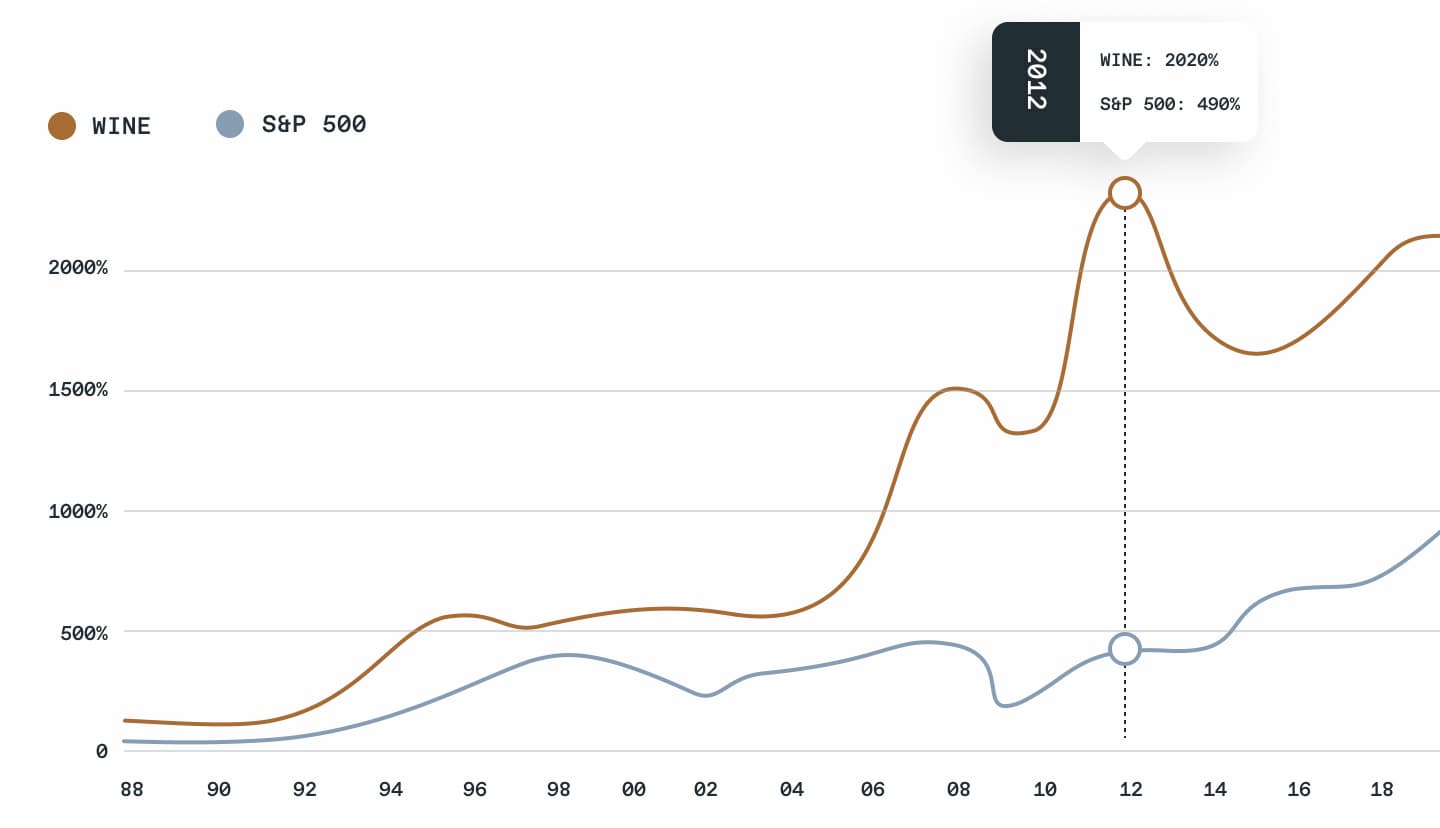

The fine wine market has outperformed most global equities and exchange-traded funds (ETFs) and is less volatile than real estate or gold. More importantly, it has delivered 13.6% annualized returns over the past 15 years.

You can bank on fine wine investments to

- Diversify your investment portfolio or asset class.

- Manage portfolio risk.

- Counter any market volatility.

What Is Investment-Grade Wine?

A fine wine that has a chance of increasing in value after around five years is known as investment-grade wine.

Characteristics of Investment-Grade Wines

A 12-bottle case of Domaine de la Romanée-Conti 1988 fetched around the US $305,000 last year.

But how do you go about identifying great investment opportunities like these?

You would know if the wine is worth your money based on these factors:

- Age-worthiness: Do the finest wines really get better with age? To be investment-worthy, you need to know whether a wine is age-worthy or not. It should have the right mix of acidity, alcohol, flavor, and tannins to increase in quality as it ages.

- Scarcity: An investment-grade wine – like the Dom Perignon 2002 – is finite and decreases in quantity over time. Limited edition wines are usually (expensive, and) more valuable. Futures (wines that are still in the barrel) are cheaper and give you the first chance to buy a new vintage wine. While en primeur investing (buying wine while it is still in the barrel) is riskier, you could increase your margins if the price goes up after they’re bottled and stored.

- Critics ratings: High-quality wines that are rated as “classic” or equivalent (a rating of 95 on a scale of 100) by wine critics are investment-worthy.

- Pedigree: Investment wines are made by winemakers of high reputation. Wines made in the Bordeaux region, Burgundy, Rhone Valley, Tuscany in Italy, and in other areas designated as “viticultural areas” tend to be more valuable over time.

- Longevity: Investment-grade wines reach peak maturity at least 10 years after bottling, and can even age for over 25 years.

- Price appreciation: The wine price must have appreciated over a 10-year period, or longer.

But what if you’re investing in a new wine with no history at auctions? How would you know if it’s a good investment or not?

Check the price appreciation track record of previous vintages from the same winery. If it comes from an exceptional vintage year and Is produced in a famous region like Bordeaux or Burgundy, it stands a good chance of future appreciation.

Here is a practical way to invest in wine.

Use Vint

Vint is the first fully transparent wine investment platform genuinely accessible to everyone. For less than $100, you can own SEC-qualified shares of the best wines in the world.

Vint’s team of industry experts constructs and curates collections of the best wines in the world with a focus on quality, provenance, value, and market demand.

Their mission is to make the wine market investable in the most efficient way. They do this by increasing transparency, promoting diversification, removing barriers to entry, and putting the choice in the hands of our users.

Transparency

Vint collections are SEC-qualified and completely transparent. They provide their investment thesis and data to support the collections.

Low Barriers

Vint collections are properly stored & insured with shares below $50. They make the process easy for anyone to get started.

No Annual Fees

Vint takes no annual fees. They align their incentives with investors by taking a sourcing fee & buying shares alongside their investors.

Investing in Wine has Never Been Easier

Create An Account

Simply enter your information and gain exclusive access to collection details, Vint news & educational materials, and community events.

Browse The Collections

After signing up, you are able to view all past and upcoming collections. For upcoming collections, the complete details are made available exclusively to our account holders 5-7 days ahead of launch.

Build A Balanced Portfolio

With Vint, you have the ability to buy shares in collections of the best wines in the world. Build a diverse portfolio or only invest in your favorite region, it’s up to you!