Personal Capital has risen to become one of the most popular financial management platforms available. It comes in two versions, the Free Financial Dashboard and the Wealth Management service. The free version is primarily a budgeting application, but it provides abundant tools for investing. The wealth management version is a full investment management service, working somewhat like a Robo advisor, but providing a generous amount of live support from financial advisors.

Personal Capital is used by nearly two million people, who primarily use the free version. But the wealth management service takes in more than 25,000 clients, who have more than $14 billion in assets under management. The company was founded in 2009 and is headquartered in San Carlos, California.

Most users start out with the free version, then upgrade to the wealth management service if they want direct investment management of their investment portfolios. But even if you don’t upgrade, the free version offers so many investment tools it’s worth having for those alone.

As noted at the beginning, Personal Capital offers two versions, the Personal Capital free Financial Dashboard, and Personal Capital Wealth Management. While they’re related services, they provide very distinct functions. Let’s take a look at each individually.

Personal Capital Free Financial Dashboard

Though this version is often seen primarily as a budgeting app, it’s actually fairly limited in that regard. However, the investment tools are extensive. Even if you have no intention of using Personal Capital for budgeting, the free version will provide valuable investment support.

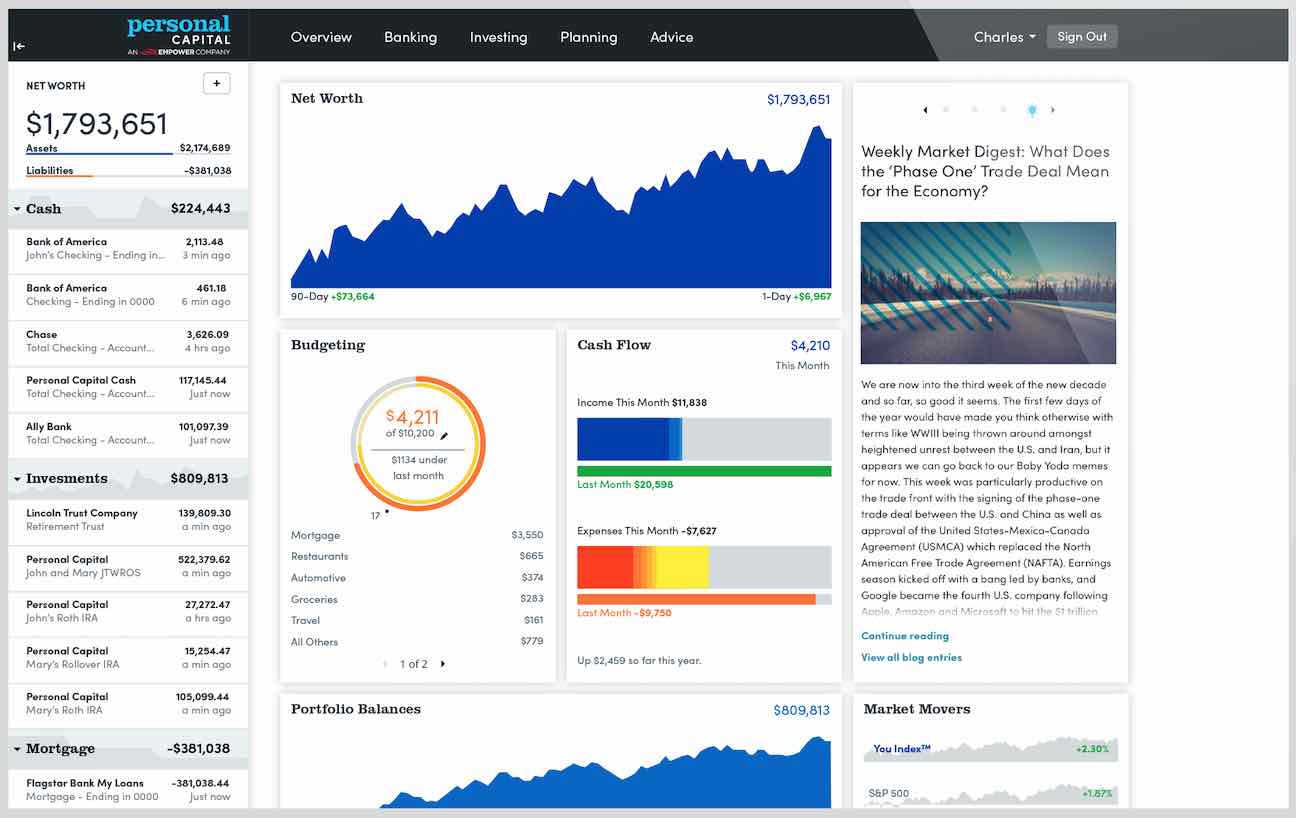

The dashboard serves primarily as a financial aggregator, where you can include all your accounts. That includes investments, savings, checking, loan accounts, and credit cards. It allows you to assemble your entire financial life on a single platform. You can even include any employer-sponsored retirement plans you have–in fact, this is the free version’s specialty.

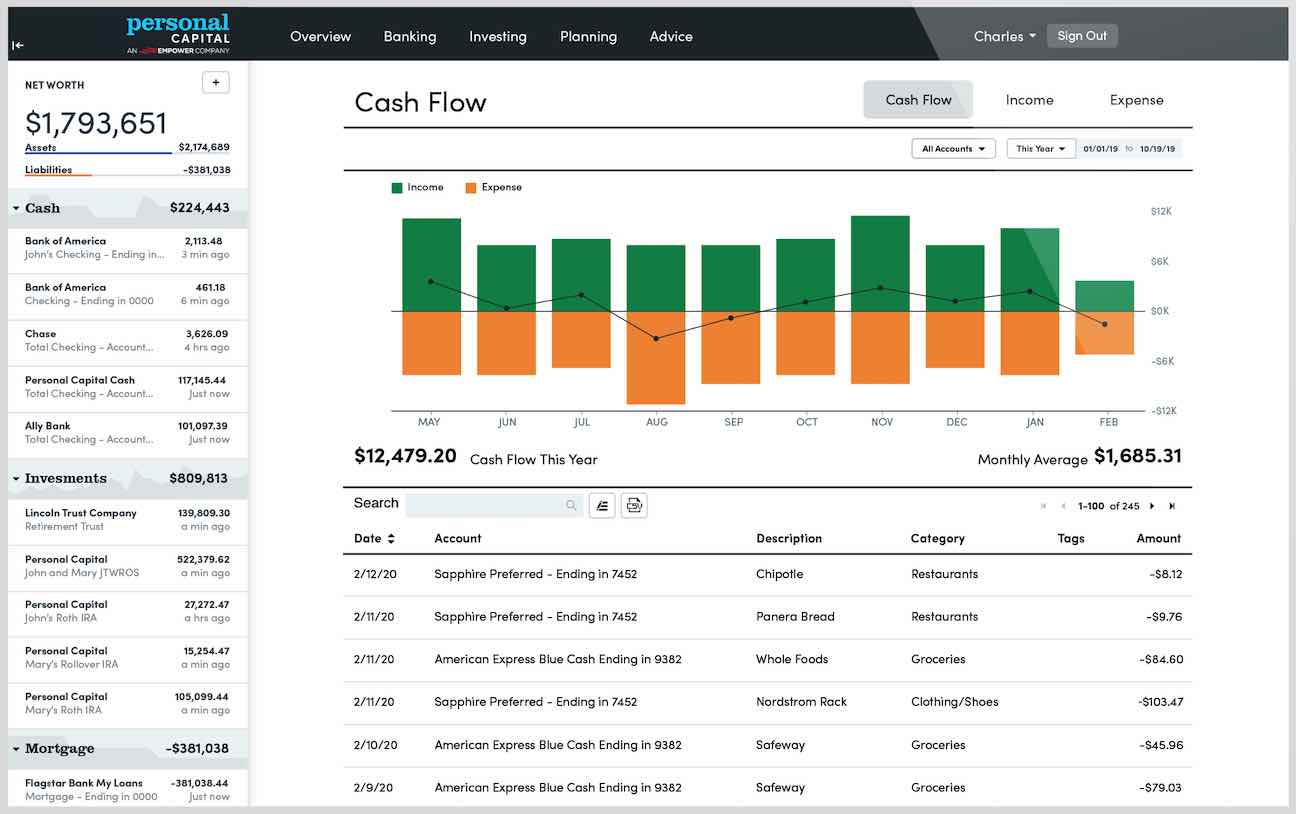

Budgeting. You can use the free version to track your cash flow and spending patterns. You can also analyze your spending categories and individual transactions. You’ll get monthly summaries, helping you to know exactly where your money is going. However, if you’re looking primarily for budgeting software, you probably won’t use Personal Capital. For example, while the platform provides alerts of upcoming bills, it does not provide a bill payment function. You will have to continue to pay your bills directly from your bank accounts.

Cash Flow Analyzer. This tool creates a budget for you. Once set up, it tracks your income and expenses from the different financial accounts you’ve linked to the platform. You can then set financial goals, like preparing for retirement or paying off debt. The analyzer will help you develop strategies to reach your goals.

Despite the Personal Capital Financial Dashboard’s limits on the budgeting side, it’s an excellent service when it comes to investment management. It offers the following investment tools:

401(k) Analyzer. Millions of people participate in employer-sponsored retirement plans. But few are aware of the investment fees that are hidden in those plans. The analyzer will show you exactly what each fund in your plan is costing you. It will then suggest alternative allocations into lower-cost funds.

Retirement Planner. The planner uses a series of “what if” scenarios, to help you determine if you’re on track with your retirement goals. You can adjust for changes in your situation, such as a job or career change, the birth of a child, or even saving for college. It takes into account outside factors that can have an impact on retirement.

Cryptocurrency Tracking. Personal Capital now allows you to track your cryptocurrency on hundreds of different crypto exchanges. You can track thousands of different token types, too, including Bitcoin, Ethereum, and Litecoin. This is a great feature for those adding crypto to their portfolio and who want to keep up-to-date on the price.

Investment Checkup. This might be the most important investment tool of all. Once you aggregate your investment accounts on the platform, this tool will help you to optimize those accounts. It can recommend adjusting your portfolio mix to improve your overall investment performance.

Net Worth Calculator. By tracking your assets and liabilities, you can quickly determine your net worth. That’s important because net worth is the most significant number in determining your overall financial strength.

Personal advisor. Even though the Financial Dashboard is free to use, you’ll still have the ability to contact a personal advisor. The advisor won’t be able to provide investment advice, but they can help you with questions regarding the service, as well as provide additional information on any recommendations made by Personal Capital.

Personal Capital Features

As I mentioned above, Personal Capital is a one-stop shop for financial management. And since it’s free, it’s worth taking a trial run to see how it can work for you. Here are my favorite features:

- Aggregate All Financial Accounts in One Place

- Monitor Net Worth

- Track Your Spending

- Improve Your Investing

Let’s take a more in-depth look at all of these features.

Aggregate All Financial Accounts in One Place

One of the biggest problems I ran into was understanding where all of my money was. Not because I had too much money, but because I had too many accounts. Between my wife and I, we have multiple bank accounts, retirement accounts, credit cards, a mortgage, and some business accounts. Seeing everything in one place makes it easier to get a handle on managing our finances.

At the minimum, I think everyone should review each of their financial accounts at least once per month to verify the accuracy of the transactions and to make sure everything is in order.

I still try to log into every account each month. But Personal Capital will also do it for me. When you use a tool like Personal Capital, you can link multiple financial accounts to your dashboard. You do this by entering the login information for each financial account into the Personal Capital interface.

Each time you log in to Personal Capital, they automatically log in to each linked account and bring back the data, which you can then review in different ways. This is a read-only tool, which means you can’t change anything in your account, make transactions or withdrawals, or move money.

Monitor Your Net Worth Over Time

It’s good to know your net worth, which is generally defined as assets (things you own) minus liabilities (things you owe). Personal Capital will automatically calculate your net worth each time you log in to your account. The software will log in to all your accounts and update your most recent information. Then it will add the assets and subtract your liabilities, leaving you with your net worth. The final number is a measurement of your financial health.

Some people get wrapped up in their overall net worth number. I think it is good to know, but I don’t think it’s the most important metric for financial health (cash flow, human capital, and other metrics can be more important in some situations).

In my opinion, knowing your net worth is a good relative metric, which can show you how your financial health is changing over time. Depending on how many accounts you have, calculating your net worth can be a time-consuming task. Then tracking and analyzing that information over time can add another layer of fun (or hassle)! Personal Capital tracks your net worth automatically.

Track Your Spending

Tracking your spending can be an important tool for saving money. We often don’t realize how much we actually spend on certain items, and it’s not until we track our spending over time that we are able to see these trends and take the appropriate actions. Tracking our spending has opened my eyes to several areas where we were spending money that didn’t align with our long-term goals. But you have to be aware of your spending habits before you can change them.

There are many programs you can use to track spending. Many banks allow you to categorize your income and spending. And this works well if you only have one bank. But it doesn’t always work as well if you have multiple accounts.

There are other programs as well, including a written ledger or notebook, Excel spreadsheets or Google Docs, Mint.com, and Quicken. All of these tools can work well. And Mint and Quicken both sync to many bank accounts like Personal Capital. But Mint and Quicken aren’t as powerful when it comes to tracking and understanding your investments. So I opted to go for the all-in-one solution and track my spending with Personal Capital.

Improve Your Investing

Managing multiple financial accounts can be tricky. In general, you should view all your investments as one giant portfolio. There are certain factors you should also consider, such as which investments to put into retirement accounts, and which should be in taxable accounts. But they should all be viewed together when it comes to asset allocation.

Balancing your investment portfolio can be easy if you only have one or two accounts. Say a Thrift Savings Plan account, and an IRA. But when my wife and I were married we each had both of those accounts, so we already had 4 investment accounts to look at when balancing our portfolio. Within 2 years of marriage, I had two more 401k plans and a pension to add to the mix, and my wife had a civil service TSP account. Managing 8 investment accounts is substantially more difficult than managing 4 accounts!

The problem with managing multiple investment accounts is not always understanding how all your investments work together. Is your portfolio diversified? Do you have too much weight in any one type of fund? Personal Capital makes it easy to see how all your investments work as one investment portfolio.

You will no longer have to guess what your total asset allocation is for each sector. Personal Capital does it for you automatically, as well as shows you how much you are spending on asset management fees. This makes it easy for you to quickly see where your portfolio is in balance, and where it needs attention. You can then use this information to make informed decisions, such as rebalancing your portfolio, selling assets in certain classes, buying others, etc.

How to Open a Free Personal Capital Account

As I mentioned, Personal Capital is free to use. All you need to do is visit their website, open an account, and then link a financial account. Once you do this, you will be able to play around with the features and see how powerful it is. HERE is where you can find more information.